In the Trenches of the Chip War

Dr. Morris Chang, the legendary founder of TSMC and pioneer of the “foundry model”

Semiconductors are the backbone of modern society, dictating everything from the processing power in your smartphone to geopolitical tussles between the great powers. They are also among the most complex technologies ever built, requiring thousands of ultra-specialized companies to collaborate across a bewilderingly complex supply chain. It is nothing short of a miracle that this 65-year old industry can fabricate chips the size of a fingernail and containing billions of miniature transistors (each more than 10,000 times thinner than a human hair), while also making them affordable enough to power everyday consumer devices.

Surprisingly for an industry of such significance and wonder, there are very few books that provide a comprehensive overview of the field. The one notable exception is Chip War by Tufts University historian Chris Miller. Deeply researched and incisive, it is the first book to show how technological, economic and geopolitical forces have shaped the chip industry from its inception to the present day. It is also perhaps the most accessible and compelling introduction to the semiconductor supply chain. Miller brings immense clarity to a subject that has not only captivated the public interest lately, but which also increasingly determines the national security priorities of the United States and its allies. With US-China tensions rising over Taiwan, Chip War might well be the best and most timely industry book since Daniel Yergin’s Pulitzer Prize-winning The Prize (originally published in 1990), which provided the definitive account of the global oil industry.

From Vacuum Tubes to Microchips

The semiconductor industry traces its origins back to two scientific breakthroughs that occurred shortly after the Second World War. The first milestone was the invention of the transistor in 1947, which replaced the vacuum tube as the principal component of computers; the second was the advent of the integrated circuit in 1958, which packed multiple transistors onto a single block of silicon. Subsequent developments allowed chipmakers to shrink the size of transistors, which was crucial: the smaller the transistors were, the faster and more energy efficient they became, and the more could be squeezed into a given space. Before long, the race was on to cram more and more transistors into less and less space. This gave rise to Moore’s Law––Gordon Moore’s famous prediction that the number of transistors on a chip would double every two years or so, thereby also doubling a chip’s performance.

As is often the case, the first customer for such cutting-edge technology was the military. Missile technology had become a key priority of US defense efforts in the 1950s and 1960s––both to get people into space and to guide missiles accurately to the Soviet Union. The problem that both NASA and the US Air Force faced was that they couldn’t take a room-sized computer and put it on a missile. The only way to get enough computing power into these devices was to drastically miniaturize the electronic components, and particularly the transistors that went into them. So the military turned to the two leading chipmakers of the time: Fairchild Semiconductor received a huge order from NASA to supply chips for the Apollo guidance computer, while Texas Instruments was tapped for the Minuteman II missile. In due course, the US military was deploying semiconductors across all types of weaponry, from satellites to torpedoes. The Soviet Union, by contrast, never found a way to miniaturize computing power and resorted to a “copy it” strategy to keep up with American innovation.

One recurring theme in Chip War is how America’s lead in semiconductors was crucial for maintaining military supremacy during the Cold War. Most histories of that period gloss over the role of semiconductors, instead focusing on the space race, the nuclear arms race, the role of espionage, or the countless proxy wars that the two superpowers fought all over the world. Miller’s book is the first history I’m aware of that explores a more fundamental question about the Cold War: why could the Soviet Union build rockets and nuclear weapons, but not produce computing power hardly at all? The reasons for this gap were deeply embedded in the Soviet system, which favored risk avoidance and imitation over innovation. The results were decidedly mixed: while copying was a fine strategy for industries that saw few technological advances during the Cold War (like atomic weapons), it was a terrible strategy for an industry that galloped forward at the rate of Moore’s Law. Spying could only get the Soviets so far:

“Simply stealing a chip didn’t explain how it was made, just as stealing a cake can’t explain how it was baked. The recipe for chips was already extraordinarily complicated… Every step of the process of making chips involved specialized knowledge that was rarely shared outside of a specific company. This type of know-how was often not even written down. Soviet spies were among the best in the business, but the semiconductor production process required more details and knowledge than even the most capable agent could steal.

Moreover, the cutting edge was constantly changing, per the rate set out in Moore’s Law. Even if the Soviets managed to copy a design, acquire the materials and machinery, and replicate the production process, this took time. Texas Instruments and Fairchild were introducing new designs with more transistors every year. By the mid-1960s, the earliest integrated circuits were old news, too big and power-hungry to be very valuable… No other technology moved so quickly—so there was no other sector in which stealing last year’s design was such a hopeless strategy.”

Bob Noyce, the co-founder of Fairchild Semiconductor and Intel Corporation, who co-invented the integrated circuit in 1958

Globalizing Supply Chains

The chips that came to market in the 1960s were prohibitively expensive at first, which meant that only the military could afford them. But the exponential rate of Moore’s Law soon made it possible for chips to be used in commercial devices as well. This marked a turning point for the industry, which needed the scale of the civilian market to fund the extraordinary capital expenditures that propelled Moore’s Law forward. By 1968, the year Intel opened shop, the computer industry was buying as many chips as the military and volume was growing fast. But this was not the only important shift that occurred in the 1960s: chipmakers had also started offshoring production to Southeast Asia. Prior to reading Chip War, I was unaware just how early the US manufacturing supply chain began migrating to Asia. The driving force was labor costs: factory workers in Taiwan or Hong Kong made 19 to 25 cents an hour, compared to $2.50 in America. Miller writes:

“Fairchild continued to make its silicon wafers in California but began shipping semiconductors to Hong Kong for final assembly. In 1963, its first year of operation, the Hong Kong facility assembled 120 million devices. Production quality was excellent, because low labor costs meant Fairchild could hire trained engineers to run assembly lines, which would have been prohibitively expensive in California.

Fairchild was the first semiconductor firm to offshore assembly in Asia, but Texas Instruments, Motorola, and others quickly followed. Within a decade, almost all U.S. chipmakers had foreign assembly facilities… The semiconductor industry was globalizing decades before anyone had heard of the word, laying the grounds for the Asia-centric supply chains we know today.”

As the chip industry began focusing on DRAM memory chips in the 1970s, it opened up space for other countries to compete in a more active way. The first Asian country to capitalize on this opportunity was Japan, which invested heavily in DRAM production while also innovating in other areas. Fuelled by cheap bank loans and government support, Japanese firms launched a relentless struggle for market share, undercutting their American rivals and outcompeting them on product quality. The effects were devastating: Intel, the leading memory chipmaker of the time, saw its market share dwindle from roughly 83% in 1974 to a paltry 1.3% share in 1984. With the memory chip business in decline, Intel shifted its focus to microprocessors (what we today call CPUs). The timing was fortuitous: the rise of the personal computer market created a skyrocketing demand for microprocessors, and Intel was well-positioned to take advantage of this opportunity.

The great “DRAM wars” of the 1980s had repercussions beyond just the memory segment. In an effort to regain its competitive advantage, US chipmakers offshored even more production to Southeast Asia. This encouraged the East Asian tigers to put their own government policies in place to domesticate chip technology and move up the value chain. By providing tax incentives and other support to semiconductor firms, countries like Taiwan and South Korea were able to successfully climb the manufacturing ladder, transitioning from basic assembly work to more advanced wafer fabrication processes that yielded much greater profits. In the process, the region also deepened economic ties and strengthened its security relationship with the United States.

The Fabless Revolution

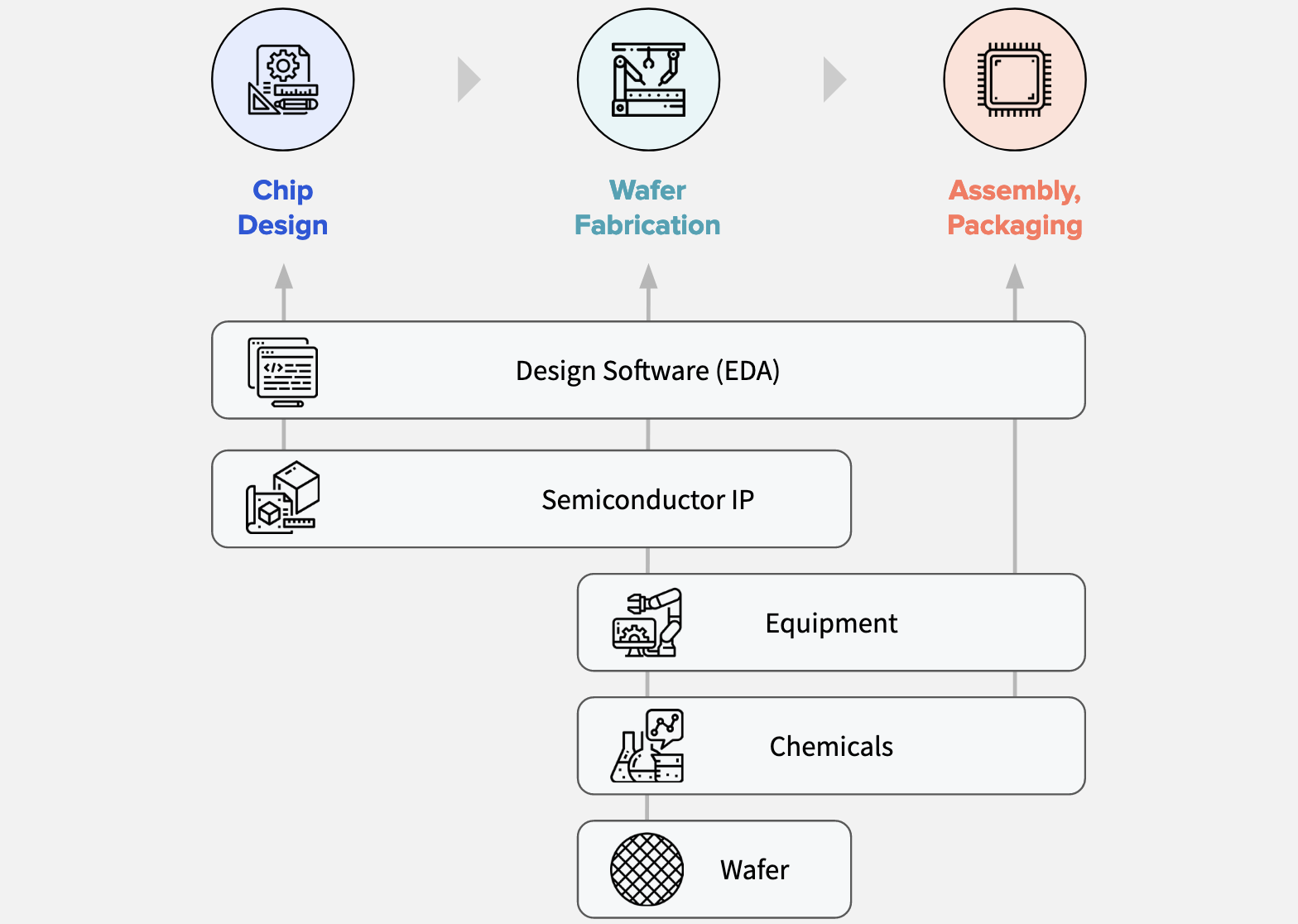

Countless innovations have kept Moore’s Law going since the 1980s, but two in particular have left an indelible mark on the industry. The first was Carver Mead and Lynn Conway’s revolution in chip design, which sprung from their influential book Introduction to VLSI Systems (originally published in 1979). Prior to the Mead-Conway revolution, chip design was a tedious process that involved manually placing and routing each individual component onto a chip’s layout. While this was a fine technique when chips consisted of only a few hundred transistors, it had reached its practical limits once circuit complexity increased to tens of thousands of components. Mead and Conway’s design methods were thus instrumental in paving the way for computer programs to automate the chip design process, making it more accessible and efficient. Over time, two entirely new sub-industries emerged, dedicated to providing specialized design software (known as EDA tools) and licensing chip designs to other firms (semiconductor IP).

Left: Metal layout for the Intel 4004, which Federico Faggin hand designed in 1971. Right: Cadence Innovus, a cutting-edge EDA tool that allows chip designers to automatically place and route standard cells onto a chip.

The second pivotal innovation was Morris Chang’s foundry model. Prior to the 1980s, virtually all chipmakers were integrated device manufacturers (IDMs), which meant they designed and manufactured their silicon in-house. This began to change gradually as fabrication plants, commonly called “fabs,” got more expensive and leading-edge process technologies became increasingly complicated. By the 1980s, the cost of starting a chip company with its own manufacturing capabilities had reached $50-100 million, compared to one tenth without it. The barriers to entry were so daunting that a new breed of startups—among them Xilinx, Qualcomm, and later Nvidia—began looking for ways to outsource their manufacturing and go “fabless.” Initially, this meant purchasing excess foundry capacity from IDMs like Texas Instrument or Intel, since only they owned fabs.

Chang saw an opportunity to take the separation of chip design and manufacturing further: in 1987, with the backing of the Taiwanese government and Dutch tech powerhouse Philips, he founded TSMC. As the world’s first “pure-play” foundry, TSMC enabled fabless companies to shed the high fixed costs of running a fab and specialize in the design of advanced chips. Although TSMC’s technology lagged behind competitors at first, it benefitted from a virtuous cycle of scale: the more chips it produced for customers, the more experiments it could run to refine its production process and increase the “yield rate” (the percentage of usable chips in a finished wafer). This drove down the price per chip and made TSMC extremely cost-competitive. As more customers flocked to TSMC, it also provided Chang with the capital to invest heavily in the next “process node” generation, which drove further growth. Once this flywheel was in motion, it allowed TSMC to catch up to the leading edge and eventually surpass its competition.

Source: “The Integrated Circuit Industry at a Crossroads: Threats and Opportunities,” by Salvatore Pennisi (Chips, 2022)

While TSMC was catching up, other companies were dropping out of the race to build the most advanced chips. The economics of the foundry business mandated relentless consolidation: chip manufacturing today is extremely capital intensive, it is difficult to master, and there are huge economies of scale that accrue to it. To quote Morris Chang, “this business is like a treadmill that speeds up all the time. If you can’t keep up, you’ll fall off the treadmill.” And fall off they did: over the past two decades, the industry has gone from around 25 companies producing logic chips at the cutting edge to just two: TSMC and Samsung. Among them, TSMC stands out as the only company right now capable of manufacturing the most advanced chips at both high quality and scale. Miller aptly contrasts the outcome of the “fabless revolution” with the transformative impact of Johannes Gutenberg’s printing press:

“Carver Mead had prophesied a Gutenberg moment in chipmaking, but there was one key difference. The old German printer had tried and failed to establish a monopoly over printing. He couldn’t stop his technology from quickly spreading across Europe, benefitting authors and print shops alike.

In the chip industry, by lowering startup costs, Chang’s foundry model gave birth to dozens of new “authors”—fabless chip design firms—that transformed the tech sector by putting computing power in all sorts of devices. However, the democratization of authorship coincided with a monopolization of the digital printing press. The economics of chip manufacturing required relentless consolidation. Whichever company produced the most chips had a built-in advantage, improving its yield and spreading capital investment costs over more customers… Morris Chang wanted to become the Gutenberg of the digital era. He ended up vastly more powerful.”

Other parts of the supply chain have experienced similar waves of consolidation. There are more than 50 types of equipment and 400 different chemicals that foundries must source from upstream suppliers. For many of these inputs, there are only a few––and sometimes just one––supplier in the world. The most prominent example is the Dutch company ASML, which builds 100% of the world’s extreme ultraviolet (EUV) lithography machines. Without ASML’s machinery, it would be impossible to make the most cutting-edge chips. Market concentration, coupled with formidable barriers to entry, have translated into substantial pricing power for equipment vendors: the costs of photolithography tools, for example, have risen from $450,000 per unit in 1979 to $150 million today. This dramatic increase in equipment costs is the main reason why building a modern fab exceeds $20 billion today––a prohibitive amount for even the most well-capitalized companies.

Source: “The Global Semiconductor Value Chain: A Technology Primer for Policy Makers,” by Baisakova & Kleinhans (SNV 2020)

The Taiwan Question

The reliance of the chip industry on a handful of countries and companies has created immense “choke points” and vulnerabilities in the supply chain. The American trade body SIA reckons that about 75% of the world’s total chip manufacturing capacity resides in Asia today. Taiwan alone fabricates 37% of the world’s logic chips, while South Korea supplies more than half of the world’s memory chips. The concentration is even more pronounced at the leading edge: TSMC produces a staggering 92% of the most advanced logic chips, with the rest coming from Samsung. Most of their fabs are uncomfortably close to China and North Korea, making them a top national security concern for the United States and its allies. If, for whatever reason, Taiwan’s fabs were knocked offline tomorrow, the chip industry would produce 37% less computing power and barely any cutting-edge chips the following year. The impact would easily dwarf the Russia-Ukraine War. To quote from a recent interview that Chris Miller gave to the Council on Foreign Relations:

“Losing access to Taiwan-produced chips would be disastrous, the worst disruption to manufacturing output since the Great Depression. Today, almost every electronic device has chips inside. The world’s production of smartphones would fall by far more than half. Many PC processors, including those Apple uses, can currently only be made in Taiwan. Almost all of the graphics processing unit (GPU) chips that run artificial intelligence (AI) applications in data centers are made in Taiwan. Some of America’s biggest technology companies would struggle to produce much of anything.

In the case of a Taiwan crisis, it would take years to build up capacity offshore, because there’s a limited supply of the ultra-complex tools needed to make chips. What’s more, these machines have chips inside, too. During the recent chip shortage, companies that manufacture chipmaking tools reported delays too, because they didn’t have all the chips they needed. Replacing chipmaking capacity in Taiwan would take years, and the delay would impose several trillion dollars of losses to global manufacturing.”

While a near-term military conflict over Taiwan remains unlikely, the longer-term picture is less clear. What’s certain is that a military confrontation in the Taiwan Strait, or even just a blockade, would guarantee “mutually assured economic destruction” for everyone involved. The problem is that the Russia-Ukraine War has cast some doubt on whether economic interests would actually deter China from making a move on Taiwan. Miller provides an interesting analogy from the recent past: he argues that Angela Merkel’s energy policy—which steered Germany away from nuclear power and towards renewables and Russian gas—was, in part, predicated on the thesis that economic interdependence with Russia would deter the Kremlin from any aggression against Europe. The result proved to be the opposite of what Merkel had hoped for. In a strange twist, the future of the global economy now hinges on the durability of Taiwan’s “silicon shield” and the speed at which supply chains can be diversified to improve their resiliency.

Thanks to Max, Ricardo, Serag, and Shubho for reading the final draft of this piece.

The online magazine 1E9 has published a German translation of this essay.